Bank

Banks are financial institutions that are license by the government to accept deposits, flat loans and derive a profit from the margin between the interest rate levied and the interest rate paid. They also act as a channel in legitimate financial transactions like transferring of money through legal channels and provide other financial services to its customers such as wealth management, currency exchange, safe deposit boxes, investing in mutual funds, shares and stocks. In most countries they are helmed by the Central Government or Central Bank, which is the Reserve Bank, in case of India.

Banks usually fall under three categories:

1. Central Bank: Primarily responsible for ensuring currency stability, check inflation and monetary policy and overseeing money supply. E.g.: Reserve Bank in India.

2. Commercial Banks: Responsible for all commercial operations involving receiving deposits from individuals and companies, managing withdrawals and offering short term or long terms loans to individuals and small businesses. Also provide vault facility and home mortgage or home loan facility.

3. Investment Banks: Provide corporate clients with financial services like underwriting and assisting with Merger and Acquisition procedures. E.g.: Citibank / Yes Bank in India. Morgan Stanley in U.S has a global presence in this genre.

They are critical to the well-being of a nation. They create assets in the economy by offering loans depending on the minimum reserve requirement as fixed by the Federal Reserve, which varies between 3 to 10%. The amount can either be kept as cash in hand or bank’s reserve account with the Fed. Banks allocate loans from saving funds borrowed from individuals, financial institutions and government with surplus funds to borrowers in an efficient and legal manner, thus enabling the economy to become more efficient

When India got its independence in the year 1947, the biggest challenge , apart from ensuring the integrity of the nation, lay in focusing on the rebuilding of the economy that lay in shatters after around 200 years subjugation under the British regime. The government of India initiated measures to play an active role in the economic life of people, mixed economy system was adopted, which provided the State with a greater say in banking and finance. The Reserve Bank of India, set up in 1935, was nationalized on 1st Jan, 1949 having the power to regulate, control and inspect banks in India.

Cut to 1960, despite provisions to control by RBI, most banks remained operated by private persons. But banking was recognized as an important tool to facilitate the development of Indian economy and hence in accordance with an ordinance issued in 1969, 14 largest commercial banks were brought under the nation’s control, followed by 6 more in 1980.

Since 1990s when liberalisation was unleashed, scores of private banks have come up to revitalise the banking sector in India. The stage for the next big leap has already been proposed with relaxation for foreign direct investment.

Today most banks are functioning with a modern outlook and tech-savvy method of functioning. Banks in India are fairly mature in terms of accessibility and product reach even though reach in rural areas can be further amplified. The demand for banks in the service sector especially retail banking, mortgages and investment sectors is expected to be strong.

Recent Articles

-

Explain about Growth in Plants |Definition of Growth & Differentiation

Feb 27, 25 02:07 PM

Growth is a permanent increase in length or volume of an organism that brought upon by an increase in its dimensions due to synthesis of new protoplasmic material. -

Definition of Respiratory Quotient | calculation | Application | Plant

Dec 02, 24 12:09 AM

Definition of respiration quotient- the ratio of the carbon-dioxide evolved to that of the oxygen consumed by a cell, tissue, plants or animals in a given time is called respiratory quotient. It is us… -

Amphibolic Pathway | Definition | Examples | Pentose Phosphate Pathway

Jun 06, 24 10:40 AM

Definition of amphibolic pathway- Amphibolic pathway is a biochemical pathway where anabolism and catabolism are both combined together. Examples of amphibolic pathway- there are different biochemical… -

Respiratory Balance Sheet | TCA Cycle | ATP Consumption Process

Feb 18, 24 01:56 PM

The major component that produced during the photosynthesis is Glucose which is further metabolised by the different metabolic pathways like glycolysis, Krebs cycle, TCA cycle and produces energy whic… -

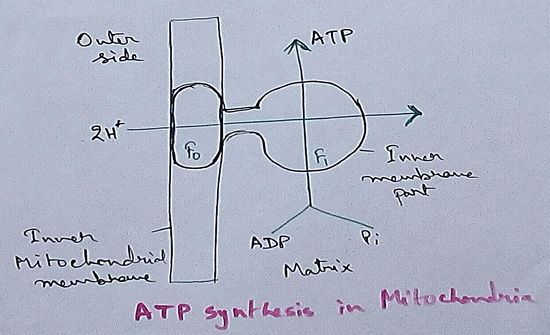

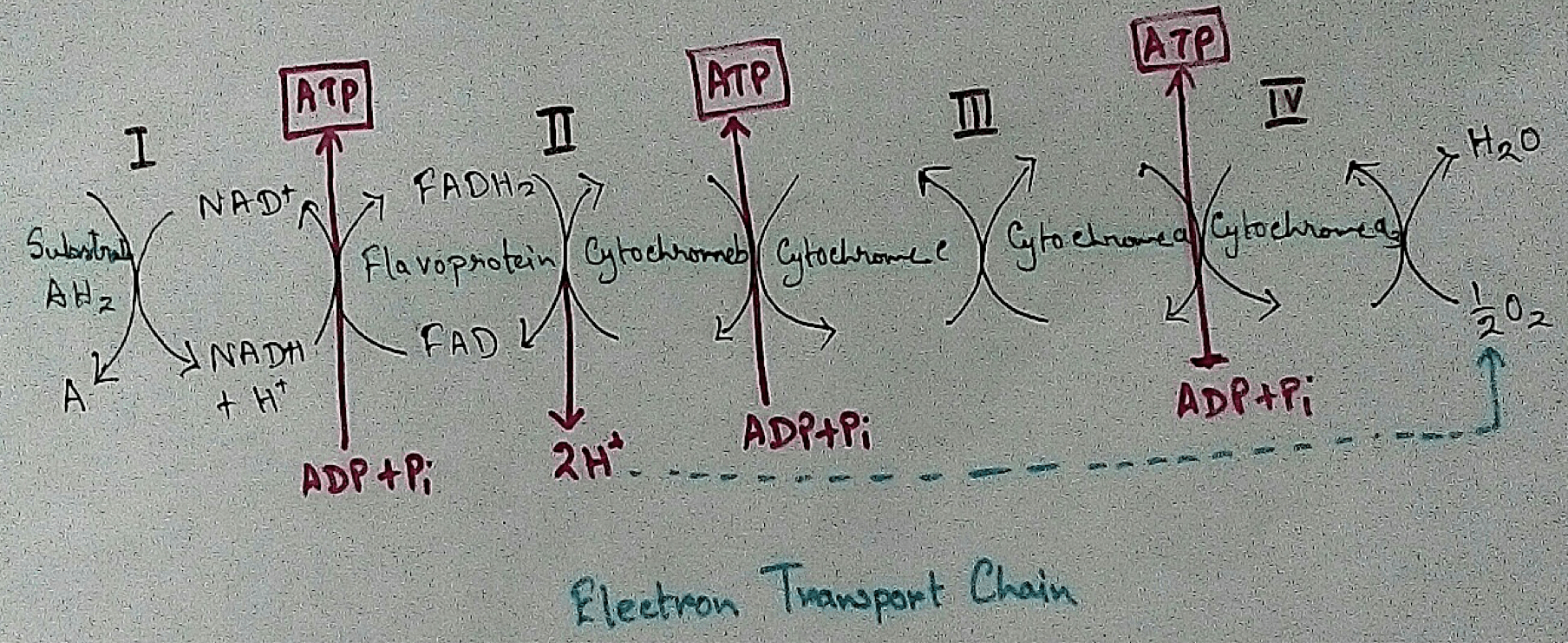

Electron Transport System and Oxidative Phosphorylation | ETC |Diagram

Feb 04, 24 01:57 PM

It is also called ETC. Electron transfer means the process where one electron relocates from one atom to the other atom. Definition of electron transport chain - The biological process where a chains…

New! Comments

Have your say about what you just read! Leave me a comment in the box below.